Most luxury property owners chase the wrong metric when comparing vacation rentals to long-term leases. They focus on gross revenue or occupancy rates while ignoring the number that actually matters: how much cash hits your account each year relative to what you invested upfront. That’s cash on cash return, and it’s the only metric that tells you which strategy puts more money back in your pocket.

We manage 2,300+ luxury properties worth over $5 billion, and our December 2025 performance data reveals something counterintuitive: the vacation rental advantage isn’t as automatic as most owners assume. Achieving double-digit CoC returns in the luxury segment requires more than simply choosing the vacation rental model—it demands professional revenue management, award-winning design, and distribution channels that drive qualified guests during shoulder seasons.

This analysis cuts through the noise with actual performance data, showing you exactly how these two strategies stack up on cash flow, expenses, and real-world returns.

TLDR:

- Luxury vacation rentals target 10-15% CoC returns vs 6-7% median market rates.

- Vacation rentals generate 3-5x higher nightly rates but carry 50% expense ratios.

- Long term rentals deliver 95-100% occupancy with fixed costs at 35% of revenue.

- Professional revenue management can reduce vacation rental expenses from 50% to 40%.

- AvantStay currently manages 2,300+ luxury properties with dynamic pricing and Marriott Bonvoy access.

Cash on Cash Return Benchmarks: Vacation Rentals vs Long Term Rentals

The numbers tell a straightforward story. Across the top 25 cities for short-term rentals, median CoC returns range from 6.16% to 7.45%. Long term rental markets in their top 25 cities deliver 5.77% to 7.12%. The vacation rental edge exists, but it’s narrower than many owners expect.

These benchmarks represent typical properties across diverse markets. Luxury vacation rentals operate in a different performance tier. Premium properties in competitive markets routinely target 10% minimum CoC returns, with sophisticated investors often requiring 15% or higher returns to justify the operational complexity and capital commitment.

The gap between median vacation rental performance and luxury property expectations reveals an important reality. Achieving double-digit CoC returns demands more than simply choosing the vacation rental strategy. You need premium positioning, professional revenue management, and operational excellence that most properties never achieve.

Revenue Generation Potential in Luxury Vacation Rentals

Luxury vacation rentals generate revenue through nightly rates that often exceed what long term leases produce on a per-night basis by 3x to 5x. A premium property leasing for $5,000 monthly translates to roughly $167 per night. That same property as a vacation rental can command $400 to $800 nightly during peak periods, depending on market positioning and property features.

Dynamic pricing amplifies this advantage. We adjust rates daily based on demand signals like local events, seasonality, and booking velocity. A luxury estate in Scottsdale might price at $600 midweek in September but spike to $1,500 during WM Phoenix Open weekend. Long term rentals remain static, leaving substantial revenue on the table during high-demand windows.

Location drives your ADR ceiling. Properties within walking distance of beaches, ski resorts, or entertainment districts consistently command premium rates. A luxury home in downtown Nashville with rooftop views will outperform a comparable property 20 minutes outside the city by 30% to 50% on average nightly rates.

Property design and amenities create pricing power. Homes with resort-style pools, chef’s kitchens, and multiple primary suites attract higher-spending groups willing to pay premium rates. Our experience managing 2,300+ properties shows that thoughtful design improvements can increase ADR by 20% to 40% without adding square footage.

Guest capacity matters more than owners realize. A 6-bedroom luxury property sleeping 16 guests can charge $800 per night, translating to just $50 per person. That per-head value proposition lets you capture bookings from groups who’d never consider a $800 hotel room but see clear value in a shared luxury experience.

Long Term Rental Income Stability and Predictability

Long term rentals deliver predictable monthly income that removes the guesswork from cash flow planning. You sign a 12-month lease at $4,500 per month, and that’s exactly what hits your account each month, barring tenant issues. This consistency simplifies budgeting for mortgage payments, insurance, and reserves without wondering if next month’s bookings will cover expenses.

Vacancy risk drops significantly with annual leases. Where vacation rentals face constant booking uncertainty and seasonal gaps, a quality long term tenant provides 12 months of occupancy from a single transaction. You’re not chasing bookings or managing calendar gaps between guest stays.

Financial forecasting becomes straightforward. You know your annual gross income on day one of the lease, making it easier to calculate CoC return, plan capital improvements, and manage multiple properties without sophisticated revenue management tools. This predictability appeals to owners who prioritize simplicity over maximizing absolute returns.

Operating Expense Comparison: Variable vs Fixed Cost Structures

Vacation rentals operate with variable costs that scale with occupancy. Every booking triggers expenses: cleaning fees, restocking amenities, utilities during guest stays, and platform commissions. Short-term rentals typically run at 50% of revenue in operating expenses, though they earn 30% more annually with average monthly earnings of $4,300.

Long term rentals follow a fixed cost model. Your expenses remain relatively stable whether the property sits vacant or occupied. Insurance, property taxes, HOA fees, and basic maintenance don’t fluctuate month to month. These properties typically operate at 35% of revenue in total costs, creating healthier margins on lower gross income.

Property management fees is the largest controllable expense. Vacation rental managers often charge ~20% of revenue plus add-ons, while long-term management runs 8–12% due to simpler operations.

These differences directly affect CoC returns. A $75,000 vacation rental with $37,500 in expenses produces more cash flow than a $50,000 long-term rental with $17,500 in expenses ($37,500 vs. $32,500 before debt service), but requires far more operational oversight.

With professional revenue management, vacation rental expense ratios can be reduced from ~50% toward 40%. Bulk purchasing, optimized cleaning, and direct bookings expand margins without compromising the guest experience.

Occupancy Rate Impact on Cash Flow Performance

Occupancy rate acts as a multiplier on your revenue potential. A vacation rental priced at $500 nightly generates zero cash flow at 0% occupancy and $182,500 annually at 100% occupancy. Long term rentals operate near 95% to 100% occupancy with quality tenants, creating predictable income streams without booking gaps.

Vacation rentals face occupancy volatility. Market averages range from 45% to 65% depending on location and seasonality. A property at 50% occupancy earning $500 nightly generates $91,250 annually versus a long term rental at $3,000 monthly producing $36,000. The vacation rental wins despite half-empty nights.

Professional management significantly improves occupancy rates. We leverage dynamic pricing, multi-channel distribution, and the Marriott Bonvoy partnership to drive bookings during traditional shoulder seasons. Our portfolio consistently achieves 65% to 75% occupancy, turning what would be vacant nights into revenue-generating stays that compound your CoC return.

Luxury Market Dynamics and Premium Property Performance

Luxury vacation rentals operate in a fundamentally different performance category than mid-market properties. Premium positioning lets you capture guests willing to pay 2x to 3x standard rates for exceptional experiences. A well-designed 5-bedroom estate with resort-grade amenities can command $1,200 nightly where a standard comparable property struggles to exceed $400.

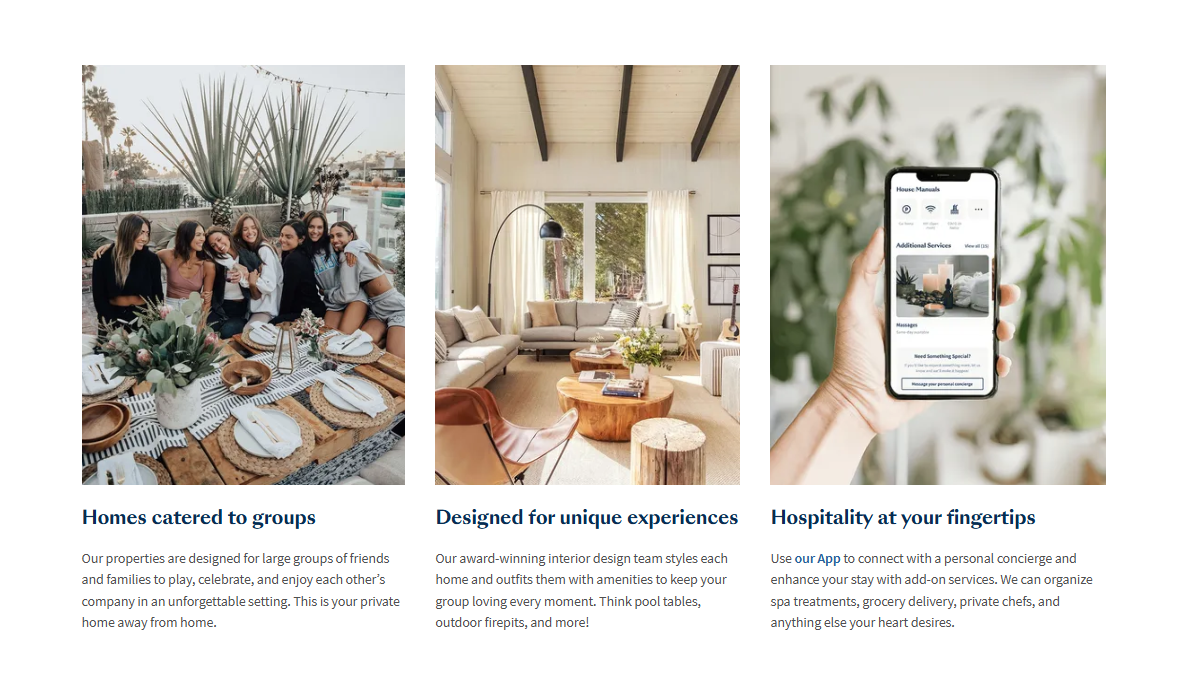

Award-winning design creates competitive separation. Properties featuring curated interiors, Instagram-worthy spaces, and experiential elements drive both higher ADR and improved occupancy. Guests booking luxury stays expect cohesive design that justifies premium pricing, not generic furniture packages.

Professional management becomes essential at the luxury tier. Sophisticated revenue optimization, 24/7 concierge services, and institutional-grade operations justify premium rates while maintaining guest satisfaction. Our experience shows that luxury properties managed professionally achieve 15% to 25% higher ADR than comparable self-managed listings.

Maximizing Cash on Cash Return with Professional Management

Professional management turns vacation rental CoC from theoretical upside into consistent returns. Our vertically integrated model is built to maximize owner cash flow by eliminating the fragmented, inefficient practices that dilute performance.

A proprietary revenue management algorithm analyzes thousands of signals—local events, flight data, and seasonality—to optimize pricing daily. This dynamic approach outperforms static long-term rents and owner-managed pricing, increasing CoC without additional capital.

Our Marriott Bonvoy partnership delivers qualified demand at scale. Access to 140+ million members boosts occupancy during shoulder seasons, converting vacant nights into revenue that self-managed listings can’t reliably capture.

Award-winning design drives higher ADR from day one. We create destination-level properties that command 20–40% higher nightly rates without adding square footage, aligning aesthetics with revenue optimization.

Finally, the Lighthouse owner portal provides full transparency. Real-time revenue, occupancy, and expense data replace spreadsheets, while our institutional-grade operations make luxury vacation rentals truly passive.

Final Thoughts on Cash on Cash Return Performance in Luxury Rentals

Achieving double-digit cash on cash return for luxury vacation rentals requires more than simply choosing the vacation rental model. You need dynamic revenue management, award-winning design that commands premium rates, and distribution channels that drive qualified guests during shoulder seasons. The gap between median vacation rental performance and luxury property returns reveals why professional management matters. Your capital investment deserves operations that convert theoretical upside into consistent cash flow hitting your account each month.

FAQ

What cash on cash return should I target for a luxury vacation rental property?

Luxury vacation rental investors typically target minimum CoC returns of 10%, with sophisticated operators often requiring 15% or higher to justify the operational complexity and capital commitment involved in premium property management.

How do vacation rental operating expenses compare to long term rentals?

Vacation rentals typically run at 50% of revenue in operating expenses due to variable costs like cleaning, amenities, and platform commissions, while long term rentals operate at around 35% of revenue with more fixed cost structures and lower management fees of 8-12% versus 20% for vacation rentals.

Can professional management really improve my vacation rental’s cash on cash return?

Yes, professional management can increase CoC returns by 15-25% through dynamic pricing optimization, improved occupancy rates (65-75% versus market averages of 45-65%), reduced expense ratios, and access to qualified guest networks like Marriott Bonvoy’s 140+ million members.

What occupancy rate do I need to make vacation rentals more profitable than long term leases?

Vacation rentals can outperform long term rentals even at 50% occupancy when properly priced, since nightly rates typically run 3x to 5x higher than the per-night equivalent of monthly lease rates, though professional management pushing occupancy to 65-75% maximizes returns.

How does property design impact my vacation rental’s cash flow performance?

Award-winning design and resort-grade amenities can increase your average daily rate by 20-40% without adding square footage, creating pricing power that directly improves cash flow and CoC returns by attracting higher-spending guests willing to pay premium rates for exceptional experiences.